How do I repay my HELP (HECS) debt?

June 30, 2019

Ever wondered how your HELP/HECS debt gets paid to the government? Are you unsure about these so called ‘thresholds’ and what they mean? We are currently rolling into a new financial year, which means some changes around tax legislation, including your HELP debt.

If you’ve been to uni, you’ve mostly likely racked up a substantial HELP debt. When I went to uni it was called HECS. So HELP stands for High Education Loan Program.

I decided to write this blog as I actually received 2 calls this week from friends who had the exact same questions around their own HELP debts. They were really confused about at what level of income HELP debt repayments would come into play and what happened if enough tax wasn’t being taken out of their wages.

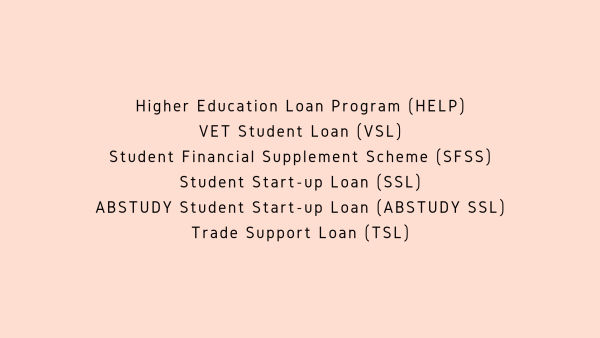

Just to note, when I talk about ‘HELP debts’ I’m also meaning a number of other study loans. These include:

So anytime I mention ‘HELP debt’ in this blog, I’m referring to these as well as the threshold is the same.

How do HELP debt repayments work?

In a nutshell once you reach a certain income threshold you have to start repaying your HELP debt based on percentage of your income. Essentially if you’re fresh out of uni and still haven’t found a well-paying job, you’re not going to be forced to pay back that debt until you reach the repayment income threshold.

Similar to how tax is calculated, the more money you earn the higher your HELP debt repayments will be. So if you are earning a great salary straight out of uni and do this for a number of years, you are going to pay back your HELP debt a lot quicker than, for example, someone who starts on a lower salary and their salary slowly increases throughout their career.

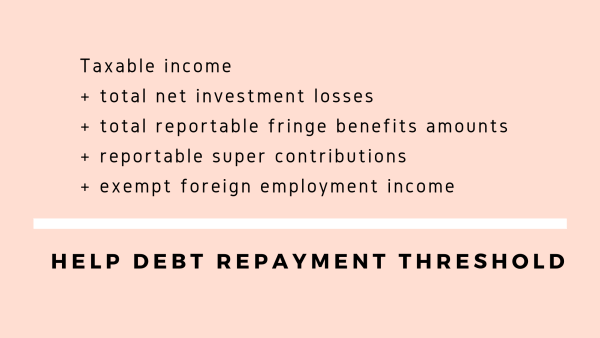

HELP debt repayment threshold

Your HELP debt repayment income is different to your taxable income. It’s calculated by:

Updated HELP debt threshold

So why is this so relevant right now? Because the threshold changed from 1 July 2019. In the 2019 financial year the repayment income threshold was $51,957. So if your income was under this threshold you didn’t have to repay your HELP debt during the 2019 financial year. Moving into the 2020 financial year the new threshold has dropped down to $45,881.

So what does this mean? It means that a lot more people are going to be captured under the new threshold and will have to start repaying back their HELP debts! A whole bunch of uni grads are going to have to start paying back their uni debts a lot sooner than expected.

Here’s the table for the 2020 financial year:

TFN declaration

When you are start a new job, it is so important to complete your tax file number declaration correctly. It’s even more important when you have a HELP debt that you tick the correct box. What happens is your employer will enter you into their payroll system as you having a HELP debt, therefore should be withholding enough tax for your normal individual income tax and HELP debt repayment.

What happens if you don’t tick this box? More likely than not you are probably going to have a tax bill at the end of the financial year because not enough tax is being withheld. So if you are an employee and unsure what you did on your TFN declaration, just check with your employer to see if they have set you up with the correct tax withholding. If they haven’t being withholding correctly, get them to update it ASAP and maybe look at saving some extra pennies for a potential tax debt – so best get some tax agent advice on this!

What happens if I am self employed?

Regardless if you are an employee or work for yourself, the rules still apply to you. It just means that you are going to have to put aside some extra money on top of the tax calculated on your taxable income. If you want to learn more about how your tax is calculated, I’ve got a separate blog on my website all about it, so you can check it out.

What about voluntary repayments

Yes, you can make voluntary repayments to your HELP debt even if you are under the current repayment threshold.

How do I check my HELP debt balance?

The easiest way to check your HELP debt balance it to log onto you’re MyGov account. Once you’ve linked the ATO you’ll be able to see the HELP debt balance. Alternatively, you can call the ATO directly or speak with you trusted tax agent for a balance update.

Debt increases

What a lot of people don’t realise is that your HELP debt increases in line with the consumer price index. So your $30k HELP debt from 5 years again, assuming your haven’t made any repayments, is going to be a little more with the CPI increases each year if you check your balance today. Currently the indexation rate was somewhere around 2%. Yes, your HELP debt is an interest free loan, but the indexation is applied to your debt to maintain its ‘real value’ by adjusting it in line with changes in the cost of living. I think of it as the value of a dollar today isn’t the same as the value of a dollar 10 years ago.

I hope this blog was helpful. Remember, tax legislation is changing all the time, so please double check the HELP debt income threshold rates before making any calculations. If you have specific questions about your own HELP debt, contact your trusted accountant to get the right advice.