Why you need 3 business bank accounts

January 9, 2023

In my experience as a business owner, you need a minimum of two bank accounts, three is best and more than three would make you end up doing more bookkeeping admin that’s not really necessary.

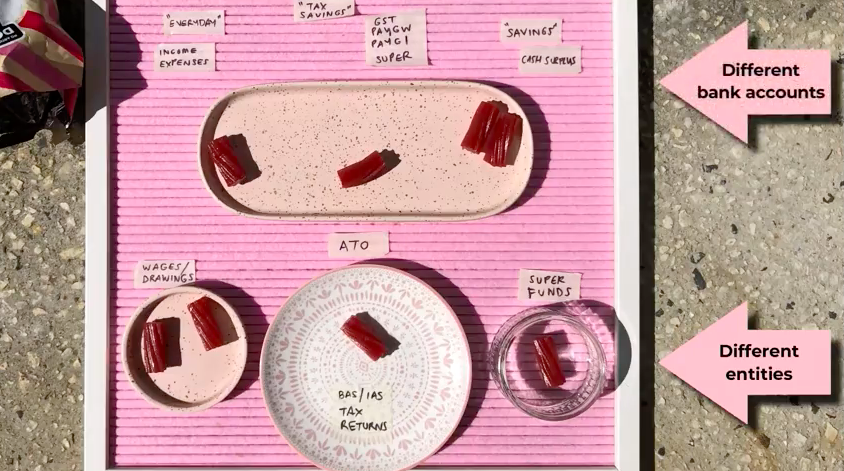

Recommended bank accounts:

1) “Everyday” bank account – where your income and expenses would flow

2) “Tax Man” or “Do Not Touch” bank account – designed to cover your GST, PAYGW and superannuation

3) Savings or “Rainy Day” bank account – if you have a little bit of cash surplus, you can put money in here for rainy days or future investments

Entities:

- Wages/Drawings – transfer funds from the Everyday account to your personal account for your wages or drawings, whether weekly, fortnightly or monthly

- ATO – from the taxman account, transfer funds to the ATO to pay your lodgements (BAS, IAS, PAYGI, tax returns)

- Super – if you have any employees or pay super for yourself, transfer funds from the taxman bank account to pay for superannuation

If you are being diligent in keeping track and keeping good habits of taking money from your Everyday account and stockpiling it into your tax man account, when you have to pay your BAS or superannuation every quarter, you can do that on a quarterly basis without having to stress that we do not have any funds to use.

You might be asking – how much to put into these bank accounts?

It all depends, and this is why it’s really important to:

1) have a structure set up

2) get really good clarity on your figures

The best way to do that is to engage your accountant or bookkeeper to set up some automated savings transfers to make sure that you can pay yourself, you can pay the ATO and you can pay the other important obligations.